The pressure is on for businesses to be transparent about their environmental impact. With mandatory climate reporting on the horizon in many regions, organisations need to be prepared to disclose their greenhouse gas emissions and climate-related risks and opportunities.

Fortunately, there are resources available to help navigate this evolving landscape. Recently, we hosted a webinar featuring sustainability expert Sarah Melville-Maguire from RSM, who provided valuable insights on navigating the complexities of mandatory climate reporting.

The following is an extract from the webinar, where Sarah gave some background information and timeline for the reporting requirements.

Note: you can always watch the full recording here.

Why mandatory climate reporting?

If you haven't been following the global ESG reporting and climate reporting space, the new Australian reporting standards may feel like they've come out of nowhere. So, I just wanted to talk briefly about what's happening globally, and how we've got to the point where we're about to have mandatory climate reporting in Australia.

From a climate change perspective, we've had one of the warmest years on record. Our greenhouse gas emissions globally have been rising consistently pretty much every year for decades.

We've seen record sea surface temperatures and huge amounts of storms, floods, and other natural disasters that have claimed over 12,000 lives globally last year, which was a huge increase on the previous year, and we're expecting that trend of increasing loss of life due to climate change to continue.

We've also seen on the back of this, a big focus on the energy transition. Renewables are being taken up at unprecedented rates globally, particularly here in Australia. And a lot of this is due, not just to those risks that come from climate change, but also those changing consumer demands and consumer expectations, and the combination of those environmental risks and the energy transition has caused regulation to change globally.

The EU is a huge leader in this space. They released some of the earliest sustainability reporting standards globally, and they're the most advanced along their journey. But it was 2022, the International Sustainability Standards Board was established, and they spent the next 18 months developing what was intended to be global reporting standards for climate and sustainability. Those were finalised just a couple of months ago.

And on the back of that, what we've seen in Australia over the last 18 months is Department of Treasury and the Australian Accounting Standards Board developing climate related disclosures for Australia.

That local contextualisation of the global international standards is what we're talking about, and what's likely to have a huge impact on businesses around Australia.

Who must report and when?

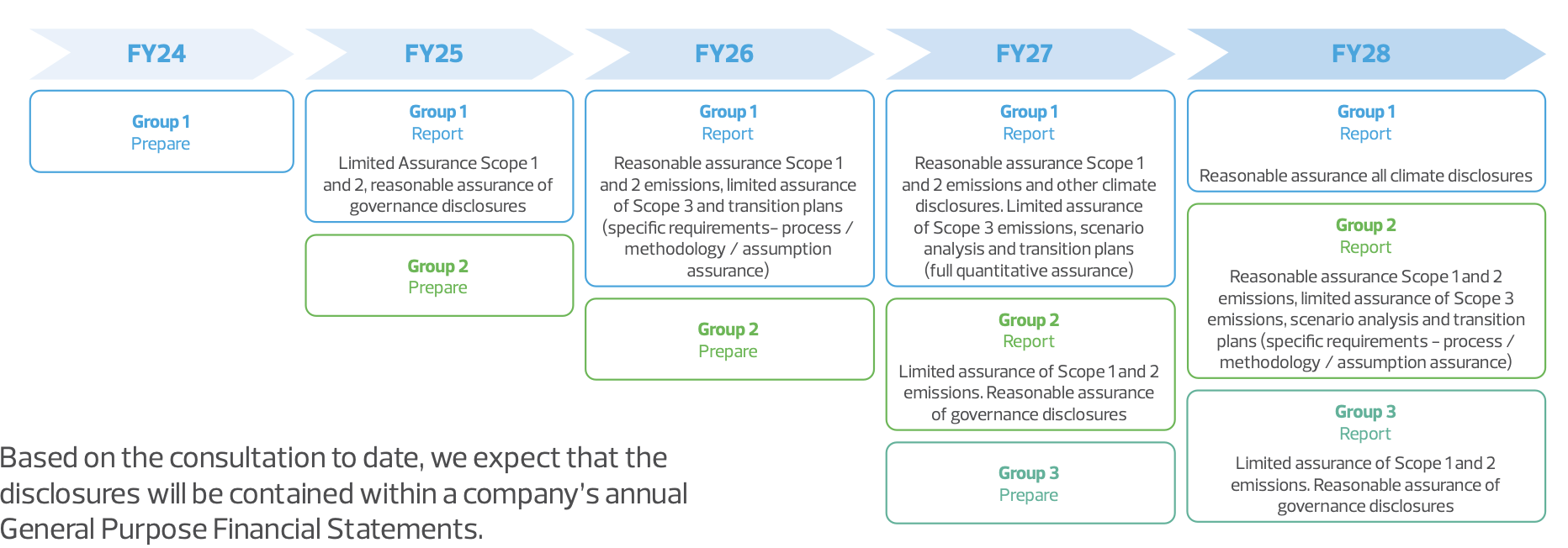

I will say that the information presented is based on those Australian Government Treasury and the Australian Accounting Standards Board's consultations that have happened over the last 18 months. So, if anything happens between now and July 1, there could be some minor changes, but with 3 rounds of consultation under our belts, we're confident in what is going to be included in the disclosures.

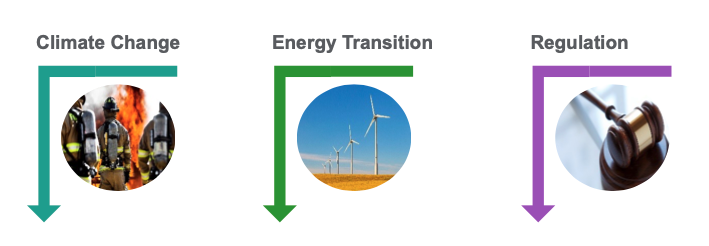

The first group that has to report is those large private and public entities that have over 500 employees, a billion dollars in gross assets, and over $500 million in revenue. It's a 2 of 3 requirements, so if you have 2 of those - over $500 million revenue and over 500 employees, but not a billion dollars in assets - you still will be a Group 1.

Also, if you’re a National Greenhouse Energy Reporting organisation that meets publication threshold, you will also have to report. So that's entities emitting over a hundred thousand tonnes of carbon dioxide at one site or facility during the year.

This group is expected to start reporting on the 1st of July 2024. That’s this year in the next financial year - which is very, very soon. Then we've got a year gap before the next group, Group 2, has to start reporting. And that's because they're hoping that Group 1 can do a little bit of the troubleshooting, finalising how those disclosures are going to look before they start to fall onto smaller entities.

And then, as of 2027, we will see Group 3 reporting which is much smaller entities and encompasses thousands of Australian companies.

In terms of the actual years and what's required in the reporting, this year is FY 2024 that we're currently in right now and we would expect that Group 1 reporters will be using this financial year to prepare. So, this means laying the foundation to make sure that you've got your emissions reporting in place, you understand how the governance processes and procedures are going to work in the organisation and stress testing and understanding how things are going to work for your particular organisation as these disclosures start to come into effect.

In the first year, you're going to have to report Scope 1 and 2 emissions, which is the direct emissions that occur as a result of your company's activities, e.g. driving cars which burn fuel, turning on lights which use electricity - and that's going to require limited assurance.

In the second year, this is expanded to a lot more detailed reporting which includes Scope 3 - which is your supply chain emissions.

And you can see this flow through the years down to Group 2 and to Group 3 when they fit into those mandatory reporting years.

Market observations

What we're seeing happen in reality in the market is that companies who are in Group 1 are already making some attempts to report against these disclosures, and they're also pushing these expectations down onto their supply chain.

So, we're seeing a lot of Group 2 reporters report much sooner than the mandatory disclosures, and we expect this trend to continue. So, even if you may be in a later Group 2 or Group 3, it's very likely that the supply chain expectations are going to push this kind of reporting on to you before the mandatory reporting occurs.

Assurance

This is something that's been recently updated in the Treasury consultations in January. Originally, there was quite a detailed plan of when assurance was going to be required over these disclosures. But some of them are extremely complex to develop, let alone to provide assurance over, and some of the strategic planning considerations are actually forward-looking statements. Thus, assurance over those is particularly challenging.

What's happened in the most recent consultation is that the Australian Treasury Department have said that they're going to leave the timeline of assurance up to the Australian Accounting Standards Board, who will prescribe the dates and years at which that assurance occurs. We do know that there will be limited assurance of Scope 1 and Scope 2 in year one.

The timeline of laying that out to reasonable assurance of all climate disclosures will happen sometime between next financial year and FY 2030. So that timeline is set to be announced in a couple of months.

In summary, the first year is quite a big deal in terms of just getting all your governance in line, and your strategy disclosures and understanding what's happening inside the business. And then that year 2 reporting is very much focused on understanding supply chain interactions and how that's going to play out.

The new reporting requirements

There are 4 pillars of climate reporting which matches with the International Sustainability Standards Board, and that's Governance, Strategy, Risk, and Metrics and Targets.

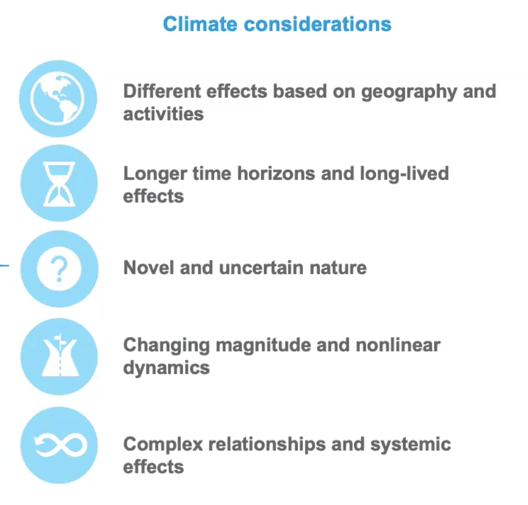

Companies will need to look at each of these 4 pillars and understand the different climate considerations for them - the different geographical activities that they have that cause different climate issues. There're going to be longer time horizons. You'll need to start looking forward into the future, into what's going to happen past your current strategic planning cycle into the future and understand those potential impacts across those 4 pillars.

It's also particularly complex because anytime you try to predict the future, you're never going to be 100% correct. And in this particular circumstance, climate change is such a complex modelling exercise and then when you start to overlay that with your business activities, it does become quite complex, and you get quite a lot of uncertainties.

It's also particularly complex because anytime you try to predict the future, you're never going to be 100% correct. And in this particular circumstance, climate change is such a complex modelling exercise and then when you start to overlay that with your business activities, it does become quite complex, and you get quite a lot of uncertainties.

Add to that that there's interrelated impacts from climate change and from the transitional impacts that you're going to have in the company. This means that if the energy transition starts to speed up and we move to more renewables and less fossil fuels, you may see less climate impact, but then you may see more transitional risk where your companies are under significant pressure to reduce emissions. And this kind of push/pull of the climate risks is something that's really front of mind during these conversations.

Impacts of climate-related disclosures

So what's going to happen for companies that are further down in the supply chain when those Group 1 reporters start reporting?

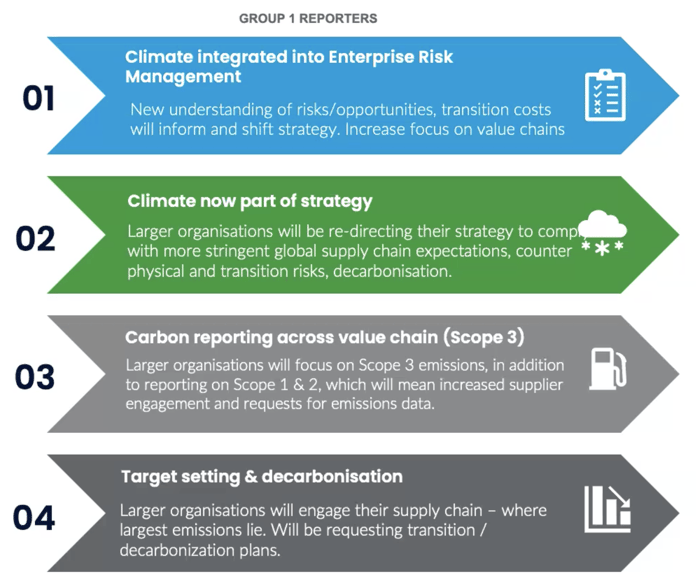

The first one is that climate is being integrated into enterprise risk management. That means that those Group 1, Group 2 and Group 3 larger companies are starting to try and understand the recent opportunities and the transition costs to their business as a result of all of the changes that are happening around climate change.

But what this means for businesses that are in their value chain - that they're purchasing from, that they're selling to - is that there's increased scrutiny around purchasing of their products, around who they're selling to, not just on climate, but also on human rights, environmental impact, and particularly emissions intensity.

The second one is that climate is now a big part of a business strategy. Gone are the days where you can write a business strategy that focuses on profit and loss and output in 5 years’ time. You now need to consider how climate could impact that strategy and your company's ability to achieve its goals.

And for a business that's in a supply chain, that means that you'll need to start to consider how your product or service can quickly transform to a low carbon, sustainable world; how can you contribute to those Group 1 entities trying to achieve their enormous climate strategies.

And of course, the big one is carbon reporting across the value chain.

So, if you're a Tier 1 business, that's all of the goods and services that you're purchasing. And what happens to your product when you're selling it into the market? The emissions associated with those activities are your Scope 3.

But if you're a smaller entity and you're providing a service or product to a large Group 1 business, that means that your emissions are their Scope 3 emissions, and you need to start collecting and reporting your Scope 1 and 2 emissions because if you haven't already been asked for this information, it's coming - you're about to be asked.

Finally, target setting and decarbonisation is the scariest thing for most organisations that we chat to.

We see a lot of tension and a lot of fear around these large organisations, particularly, those top tier multinationals have come out with lots of decarbonisation plans and net zero plans, and a lot of that includes their Scope 3 and their supply chain.

What that means for those supply chain businesses is that they now need to understand, not just what their emissions are, but how they're going to reduce them, and that's quite a challenging thing if you're a small to medium sized enterprise. So that's the later thing that you do not need to start thinking about, but it's on the horizon.

-------

Stay tuned for the next part of the series, where Sarah will dive into the research conducted by RSM into Australian companies' readiness for climate reporting, highlighting industry-specific insights.

Or watch the full webinar here.

Recent Articles

Buy vs build procurement software: Six key factors to consider before you decide

When it comes to procurement solutions, we are finding today that some organisations are at a crossroads: should they build a custom solution in-house or buy a ready-made platform that’s already proven in market? This decision matters most in a world where supply chains are complex, compliance demands are rising, and inefficient manual processes are no longer competitive.

Supplier Relationship Management: Top 10 Do's and Don'ts.

Supplier relationship management (SRM) is the backbone of a resilient supply chain. When procurement teams manage suppliers effectively, they reduce risk, improve performance, and streamline delivery across large project environments. Whether you are modernising your vendor management system or replacing manual spreadsheets, these essential do's and don'ts will help you strengthen your SRM strategy.

2025 in review: Milestones, insights and achievements

2025 – a year of that brought meaningful developments for Felix as we continue to address the evolving needs of organisations navigating complex supply-chain environments.

Let's stay in touch

Get the monthly dose of supply chain, procurement and technology insights with the Felix newsletter.